Key Insights #2: High Liquidity vs. Low Liquidity Regions

When looking at the data analyzed in the Global Rewards Liquidity Report 2023, not only can we rank the most liquid and least liquid loyalty programs, but we can also rank the six global regions by highest rewards liquidity and lowest rewards liquidity. This helps us understand what the main differences are between the regions and what the key learnings are to successfully operate a high rewards liquidity loyalty program.

The scoring method described in our previous post, “Key Insights #1: Most Liquid vs. Least Liquid Loyalty Programs”, was used to rank the regions by their Rewards Liquidity Score (RLS). As a brief refresher, the RLS is composed of four categories and an additional factor. The categories are Reward Liquidity Tax, Reward Earning Freedom, Reward Spending Freedom, and Reward Exchange Freedom, with each their own score from 0 to 100.

If you want to go straight into the Global Rewards Liquidity Report 2023, you can download it here:

Regions Ranking by Categories

Before looking at the regions by their overall Rewards Liquidity Score it is interesting to see which region has the best scores in each category.

#1 Rewards Liquidity Tax Score

Asia

55% above average

#1 Rewards Earning Freedom Score

Europe

19% above average

#1 Rewards Spending Freedom Score

South America

54% above average

#1 Rewards Exchange Freedom Score

South America

22% above average

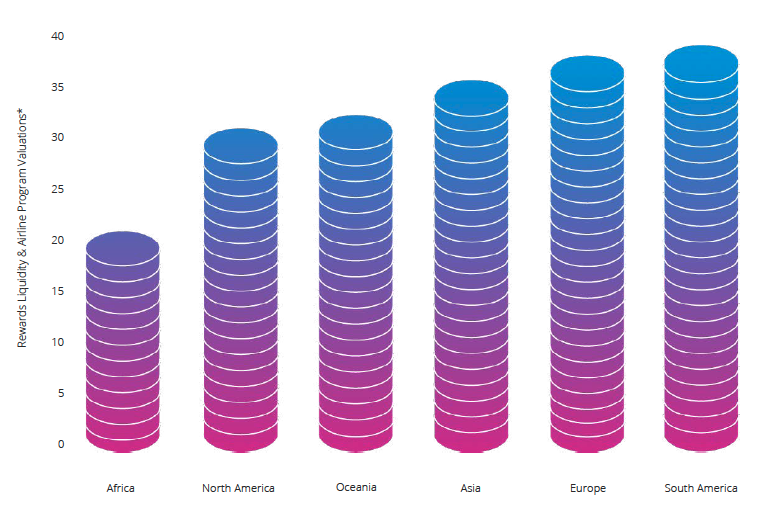

Regions Ranking by Rewards Liquidity Score

Considering the ranking by category above, it is no surprise to see that those regions are also the top three in the overall ranking.

#1 South America - RLS: 39.34

Most Liquid Program: Avianca LifeMiles

Least Liquid Program: LATAM Pass

#2 Europe - RLS: 37.18

Most Liquid Program: IHG Rewards

Least Liquid Program: Scarpetta Rewards

#3 Asia - RLS: 35.28

Most Liquid Program: Cathay Pacific

Least Liquid Program: Club Apparel

#4 Oceania - RLS: 31.66

Most Liquid Program: Qantas FF

Least Liquid Program: Myer One

#5 North America - RLS: 30.39

Most Liquid Program: Aeroplan

Least Liquid Program: DQ® Rewards

#6 Africa - RLS: 20.32

Most Liquid Program: FnB Rewards

Least Liquid Program: SK Club Rewards

Key Learning

Looking at both the ranking by category and overall ranking by Rewards Liquidity Score, we can confidently say that offering loyalty program members a high spending and exchange freedom, allows for a more liquid rewards program.

To successfully operate a loyalty program it is important to enable your members to easily earn rewards, but more importantly, they have to be able to use them in one or more ways. This inherently increases the perceived value of the loyalty program and gives your members the freedom to use their rewards more freely and to their liking, boosting their engagement and incentivizing them to earn more points by returning to purchase.

Our Global Rewards Liquidity Report 2023 is full of insights that can improve your loyalty program. Check it out for free!

qiibee: Access world-class brands your customers love.

Most Recent Posts

Key Insights #4: Airline Program Valuations & Rewards Liquidity

Throughout the research and creation of our Global Rewards Liquidity Report 2023, an extremely...

Key Insights #3: High Liquidity vs. Low Liquidity Industries

In our previous Rewards Liquidity post, we looked at the regional differences and Rewards...

Key Insights #1: Most Liquid vs. Least Liquid Loyalty Programs

In today’s blog post we will dive into the world’s most liquid and least liquid loyalty programs...