The 3 Strategies to Maximize Your Rewards Liquidity

In this blog post we will explore the importance of your loyalty program’s rewards liquidity. We will go through what rewards liquidity means, how it is measured, and the three strategies to maximize your loyalty point’s rewards liquidity.

What is rewards liquidity?

The rewards liquidity of a loyalty program refers to how easily their points or rewards can be earned, redeemed, utilized, or converted into other forms of value. In the same way as monetary liquidity refers to how readily cash or assets can be used, rewards liquidity pertains to the usability, flexibility, and real-world applicability of loyalty program points or rewards.

A loyalty program with high rewards liquidity tends to be more attractive to customers, as it gives them greater flexibility and a wider range of options when it comes to utilizing their earned points. It feels less restrictive and more comparable to having additional spendable currency.

How is rewards liquidity measured?

In order to measure the rewards liquidity of a loyalty program, we looked at the methodology used by the Heritage Foundation* to score the economic freedom of countries. In many ways loyalty programs are built very similar to economies and can therefore be evaluated by the same underlying principles. Let’s take look:

What is economic freedom and how is it scored?

Economic freedom measures the extent to which individuals and businesses can make their own economic decisions without interference, allowing the economy to foster. The economic freedom index or score is based on the following broad category pillars, among others:

- Government Size: reflects the Tax Burden of the country

- Regulatory Efficiency: gauges Business and Monetary Freedom in the economy

- Market Openness: allows for varied levels of Trade Freedom

Each of these categories is further divided into various subcategories that assess specific aspects of economic freedom. More on that in our Global Rewards Liquidity Report

*https://www.heritage.org/index/pdf/2022/book/02_2022_IndexOfEconomicFreedom_METHODOLOGY.pdf

How does rewards liquidity relate to economic freedom?

Beneath the fun and engaging customer-facing applications that loyalty programs are, the fundamentals are much like economies. By taking the above mentioned pillars and translating them to the basics of loyalty programs, we can see the relation:

- Tax Burden translates to Reward Liquidity Tax → Tax imposed on loyalty points when redeemed for partner goods and services.

- Business and Monetary Freedom translates to Reward Earning and Spending Freedom → How freely members can earn and spend points in a loyalty program, based on the point’s value.

- Trade Freedom translates to Reward Exchange Freedom → The ability of transferring or using points across various programs and partners.

Just like countries, it is important for loyalty programs to allow their points “economy” to foster and be used effectively by their loyalty program members.

With that understanding, of what rewards liquidity is, its basics and how it is measured, we can now focus on the three strategies that will help you maximize your loyalty program’s rewards liquidity.

Strategy #1: Simplify how your members earn points

An important step towards maximizing your loyalty program’s rewards liquidity is by simplifying the process through which your members earn points. The easier and more straightforward for your customers to earn points, the better. This means giving your loyalty program members various ways to earn points, in a clear and intuitive way. To name a few examples:

- give 1 point per unit of currency spent on each purchase

- every time a member logs in to your online store they earn points

- offer bonus points or point multipliers on select products and services

Transparency is key – customers should easily understand how their actions translate into points. The simpler the process, the more engaged your customers will be, which ultimately helps increase the liquidity of your rewards program.

Strategy #2: Offer amazing redemption options

The value and liquidity of loyalty program points largely depends on what they can be redeemed for. Offering a wide variety of attractive, relevant, and tangible redemption options that cater to the interests of your members will significantly increase your loyalty program rewards liquidity. Your members will actually have a reason to spend their points. Besides the usual discounts and coupons, here are other examples:

- perks such as free shipping for a month

- unique experiences such as making-of tour or behind the scenes tour

- unique services such as priority treatment or skip the line passes

The more desirable and varied the redemption options, the more value each point holds in the eyes of your members, leading to increased program engagement and greater rewards liquidity.

Strategy #3: Make your loyalty points exchangeable

One of the most powerful ways to boost the liquidity of your loyalty program is to make your points exchangeable. This gives your members more freedom on how they use their points, incentivizing them to spend their points on what they care about, which in turn engages them to come back to earn more points. This strategy would allow them to:

- transfer points to others

- exchange points across different programs

- even convert points into cash or other forms of value.

In a world where consumers seek flexibility, exchangeable points not only enhances the perceived value and usability of the points but can also provide you a competitive edge for your loyalty program.

Key Takeaway

Your loyalty program’s rewards liquidity determines how interesting, engaging and valuable your loyalty point is. In order to operate a thriving loyalty program it is important that your customers and members can easily earn and spend their points. As seen above with the model for economic freedom, the more monetary and trade freedom there is, the more an economy can grow. Therefore an increase in liquidity of said economy or in this case loyalty point will result in a successful loyalty program.

In our Global Rewards Liquidity Report 2023 we show you in depth data and analysis of how the rewards liquidity of your loyalty program points matters so much.

qiibee: Access world-class brands your customers love.

Most Recent Posts

Your Miles, Your Voice: Shape the Future of Shopping!

Make a DifferenceAre you eager to make an impact with your insights and earn up to 200 Miles in...

Breaking the Mold: Why qiibee’s Miles & More Loyalty App is Revolutionizing Shopify Loyalty Programs

In the realm of Shopify loyalty apps, the traditional approach often revolves around creating an...

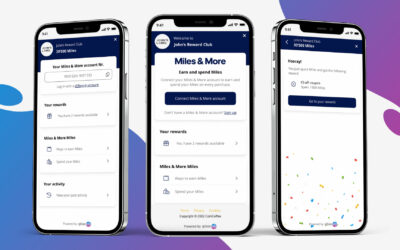

Introducing qiibee: Miles & More Loyalty App for Shopify – Elevate Your Customer Loyalty Experience!

Attention Shopify Merchants! The wait is over! We are thrilled to announce the launch of the...